Going long would be a counter trend trade, and going short would be chasing. Best thing would be just wait and see, except for day trades.

Here are some arguments against chasing the shorts:

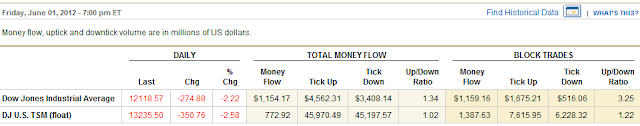

The RS for SPY are oversold at 27.32 and 29.31 in the 60 minute and daily charts, respectively. The ADX on the 60 minute is actually quite modest at 23.53, not entirely ruling out mean reversion trades. And the STO on the 60 minute chart is at a stunning 3.65 level! Last Friday's blood bath and break-down below the 200 day SMA actually resulted in a positive money flow:

With the Greece bailout meeting not until end of June, and the QE3 hint in the same time frame, the market can also take a little breather from the downside any time.

That being said, the market is officially a bear market, and the $BPCOMPQ is diving straight down.

So the best scenario is to wait for a bounce and look for opportunity to go short. Unfortunately, too many people are hoping for a bounce right now. We know what market loves to do, don't we?

No comments:

Post a Comment