While I like both CMG and PNRA, especially their menus, I can't help but toy with the thoughts of pair trades between them given the uncertainty in the current market. I am generally not a believer of hedging in terms of using options of the underlying stock -- why not simply reduce the number of shares if one is unsure? On the other hand, I am open to occasional pair trades as it is hedging involving more than 1 stock. Take the following setup with a grain of salt, do your own diligence and pull your own trigger as always.

I am pondering on shorting CMG and long PNRA. Fundamentally CMG's more expensive with P/E of 56.97 vs. PNRA's 32.49. However, CMG has a stronger balance sheet and has a good potential for a short squeeze with short float of 16.76% (PNRA has just 3.27%).

Chart-wise, it's a bit easier to justify. PNRA had a recent earnings pop and so is currently on high-pole pattern, bull-flagging. CMG, on the other hand, had a recent high volume sell-off and is forming a low-volume bear flag.

Monday, April 30, 2012

Sunday, April 29, 2012

Reflection Through My 5 Year Old

This is what my 5-year-old handed to me during the Sunday service at the church:

PS. If you couldn't make out the spelling on the left, it's a "money truck"!

PS. If you couldn't make out the spelling on the left, it's a "money truck"!

Saturday, April 28, 2012

Vintage 80's Ron Jon Surf Shop COCOA BEACH Fla. T-Shirt

Vintage 80's RON JON SURF SHOP COCOA BEACH Fla. T-Shirt:

Front of T-shirt:

Front of T-shirt:

UPDATE: Sold on Ebay for $16.99.

Thursday, April 26, 2012

Bears Are Hopefully Hopeless

Or should I say "bears are hopelessly hopeful"? Doesn't matter, both are oxymoron.

By and large the market just wants to go with the bullish trend. 20 MA is above the 50, and 50 above the 200. All MA's are pointing up. Daily RSI is 56.65 and pointing up. STO is no where close to overbought. MACD is crossing up and just turned positive.

On the other hand, the bullish setups for VXX, SPXU, TVIX, TZA, UVXY... have been foiled by the market one by one. See recent post, Don't Overstay the Flagging Welcome. It is no doubt the market punishes the bulls and the bears in turn, but it is clear which side the market favors.

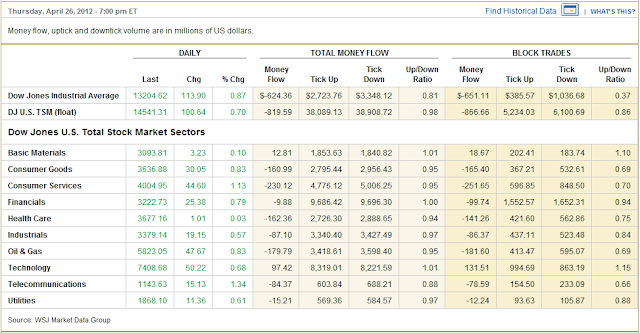

The pain is excruciating but I guess I just crave being a glutton for punishment and keep looking at the market through tinted lens. I see that volume have been declining on recent rallies. I note that $BPCOMP still flashes sells signal. I note that buydonthold.com still flashes sell signal. I see leaders broken one by one. And today I didn't see volume whatsoever on the .70% rally. And I grow suspicious with today's across-the-board rally as I see the across-the-board negative money flows (aside from basic materials and technology). I simply cannot bring myself to going long. See recent post, One Pitfall In Technical Analysis. Hopeless me.

As I mentioned earlier today, I should stop posting for a while and regroup, as I seem to suffer from this perma-bear disease and my setups had been on a losing streak. Good luck all in the mean time, especially the bears!

BTW, special thanks to the readers from the following areas (ISP locations) for your faithful readership. Sorry I am bound to miss a few.

Click (Alexandria, VA)

Click (Aliso Viejo, CA)

Click (American Fork, UT)

Click (Baton Rouge, LA)

Click (Berkeley, CA)

Click (Boston, MA)

Click (Brooklyn, NY)

Click (Brooklyn, NY)

Click (Buffalo, NY)

Click (Cambridge, MA)

Click (Castro Valley, CA)

Click (Charlotte, NC)

Click (Chino Hills, CA)

Click (Cherry Hill, NJ)

Click (Cupertino, CA)

Click (Des Moines, IA)

Click (Farmington, MI)

Click (Fort Worth, TX)

Click (Franklin, TN)

Click (Gatineau, QC)

Click (Hanford, CA)

Click (Honolulu, HI)

Click (Indianapolis, IN)

Click (Irvine, CA)

Click (Kailua, HI)

Click (La Mesa, CA)

Click (Lakewood, WA)

Click (Lebbeke, Belgium)

Click (Los Angeles, CA)

Click (Minneapolis, MN)

Click (Mississauga, Ontario)

Click (Moncton, NB)

Click (Montgomery, AL) !!!

Click (Oklahoma City, OK)

Click (Philadelphia, PA)

Click (Pleasanton, CA)

Click (Princeton, NJ)

Click (Redmond, WA)

Click (Reis, Spain)

Click (Richmond, BC)

Click (Rochester, MN)

Click (Rural Hall, NC)

Click (S. San Francisco, CA)

Click (San Diego, CA)

Click (San Francisco, CA)

Click (San Jose, CA)

Click (Sandwich, MA)

Click (Sanford, FL)

Click (Santiago, Chile)

Click (Silverdale, WA)

Click (Sunnyvale, CA)

Click (Toronto, ON)

Click (Tuscon, AZ)

Click (Warner, NH)

Click (Westerville, OH)

Click (Winnipeg, Manitoba)

Click (York, ON)

By and large the market just wants to go with the bullish trend. 20 MA is above the 50, and 50 above the 200. All MA's are pointing up. Daily RSI is 56.65 and pointing up. STO is no where close to overbought. MACD is crossing up and just turned positive.

On the other hand, the bullish setups for VXX, SPXU, TVIX, TZA, UVXY... have been foiled by the market one by one. See recent post, Don't Overstay the Flagging Welcome. It is no doubt the market punishes the bulls and the bears in turn, but it is clear which side the market favors.

The pain is excruciating but I guess I just crave being a glutton for punishment and keep looking at the market through tinted lens. I see that volume have been declining on recent rallies. I note that $BPCOMP still flashes sells signal. I note that buydonthold.com still flashes sell signal. I see leaders broken one by one. And today I didn't see volume whatsoever on the .70% rally. And I grow suspicious with today's across-the-board rally as I see the across-the-board negative money flows (aside from basic materials and technology). I simply cannot bring myself to going long. See recent post, One Pitfall In Technical Analysis. Hopeless me.

As I mentioned earlier today, I should stop posting for a while and regroup, as I seem to suffer from this perma-bear disease and my setups had been on a losing streak. Good luck all in the mean time, especially the bears!

BTW, special thanks to the readers from the following areas (ISP locations) for your faithful readership. Sorry I am bound to miss a few.

Click (Alexandria, VA)

Click (Aliso Viejo, CA)

Click (American Fork, UT)

Click (Baton Rouge, LA)

Click (Berkeley, CA)

Click (Boston, MA)

Click (Brooklyn, NY)

Click (Brooklyn, NY)

Click (Buffalo, NY)

Click (Cambridge, MA)

Click (Castro Valley, CA)

Click (Charlotte, NC)

Click (Chino Hills, CA)

Click (Cherry Hill, NJ)

Click (Cupertino, CA)

Click (Des Moines, IA)

Click (Farmington, MI)

Click (Fort Worth, TX)

Click (Franklin, TN)

Click (Gatineau, QC)

Click (Hanford, CA)

Click (Honolulu, HI)

Click (Indianapolis, IN)

Click (Irvine, CA)

Click (Kailua, HI)

Click (La Mesa, CA)

Click (Lakewood, WA)

Click (Lebbeke, Belgium)

Click (Los Angeles, CA)

Click (Minneapolis, MN)

Click (Mississauga, Ontario)

Click (Moncton, NB)

Click (Montgomery, AL) !!!

Click (Oklahoma City, OK)

Click (Philadelphia, PA)

Click (Pleasanton, CA)

Click (Princeton, NJ)

Click (Redmond, WA)

Click (Reis, Spain)

Click (Richmond, BC)

Click (Rochester, MN)

Click (Rural Hall, NC)

Click (S. San Francisco, CA)

Click (San Diego, CA)

Click (San Francisco, CA)

Click (San Jose, CA)

Click (Sandwich, MA)

Click (Sanford, FL)

Click (Santiago, Chile)

Click (Silverdale, WA)

Click (Sunnyvale, CA)

Click (Toronto, ON)

Click (Tuscon, AZ)

Click (Warner, NH)

Click (Westerville, OH)

Click (Winnipeg, Manitoba)

Click (York, ON)

TZA 60 Minute Channel

Touch down on the red channel's lower trend line, along with the horizontal gap support. RSI oversold.

I plan to stop posting for a while for the betterment of my readership. Too many foiled setups in a streak.

I plan to stop posting for a while for the betterment of my readership. Too many foiled setups in a streak.

VXX - Anyone With Any Appetite Left

Anyone with any appetite left, we're at the lower channel line right now. Catching a knife is not a good idea, by the way.

Wednesday, April 25, 2012

VXX - 60 Minute Chart

AAPL saves the market. The awful terrible goods order this morning construed as positive for QE3. FOMC announcement later. All these could be a mark up to neutralize the bad news Ben has to say later, or the first of a one-two punch for the good news Ben has to say. Who knows? The VXX cup with handle set up is broken. You can probably see where the target is going to be.

Tuesday, April 24, 2012

AAPL - Post Earnings Watch

AAPL posted earnings after the bell today. Both top and bottom lines beat estimates. Prices rallied nearly 8% after hours. 603.81. Right in the zone (circled). If AAPL cannot close in or above the zone tomorrow, I will look to short. (The cyan gap resistance is at 604.73) Regardless, I plan to start shorting it starting at 623 area.

Note: Please be reminded that you're responsible for your own trades, and that often times you'd profit by taking the opposite trades. See full disclaimer on the link on top of page.

Note: Please be reminded that you're responsible for your own trades, and that often times you'd profit by taking the opposite trades. See full disclaimer on the link on top of page.

YELP - Targets

Absolutely brutal. 20.40 on the daily and 20.46 on the 60 minutes are possible stops. Aside from the all time low of 19.36, the full target is 18.22.

One Pitfall In Technical Analysis

First one must realize that all indicators are not reliable. So even there lies a pitfall: Marrying to your indicators. Don't marry to any indicators, much less a "leading" indicator! When price action is not doing what the indicator indicates, either bail out of the trade or stick to your stops. Indicators are good for timing entries and exits - in case they are right!!

But that's not what I planned to write about. The one subtle pitfall is that when you knows quite a few technical indicators, it is easy for you to selectively tune in to some and shun others depending on your emotional bias. Take ZNGA as an example, my original set up was to add at 176% Fib extension, but because of an intraday high volume break of an intraday resistance, I front-ran my setup and went long. Now its below my entry but should I now fall back to my original plan?

But that's not what I planned to write about. The one subtle pitfall is that when you knows quite a few technical indicators, it is easy for you to selectively tune in to some and shun others depending on your emotional bias. Take ZNGA as an example, my original set up was to add at 176% Fib extension, but because of an intraday high volume break of an intraday resistance, I front-ran my setup and went long. Now its below my entry but should I now fall back to my original plan?

Another example is more common. Let's say you went long on TZA gap support, and it failed. Instead of taking loss, you saw the 20 MA not far below so you held on. It failed. And instead of taking loss, you saw the 50 MA and the 50% Fib just below as confluence of support so you held on. Sounds familiar?

You see, it doesn't mean it would go against you all the time, but it's just that it would get you into bigger trouble than otherwise.

STO is oversold, but RSI is not. What do you do? Price is bouncing, but no positive divergence. What do you do? Trend line break, but no volume. What do you do? Price break all supports but there is a strong MACD positive divergence. You see, you can easily jump the gun on any indicator while it is in fact premature. Yes, trading may be an art, but that lack of rigid rules is reserved for the masters. The rest of us have better learn the rope and stick to a set of system and rigid rules and live to trade another day in order to someday master the art of trading. If you can't blame failures on one system/setup consistently, then you probably have fallen victim of the aforementioned pitfall.

But that's not what I planned to write about. The one subtle pitfall is that when you knows quite a few technical indicators, it is easy for you to selectively tune in to some and shun others depending on your emotional bias. Take ZNGA as an example, my original set up was to add at 176% Fib extension, but because of an intraday high volume break of an intraday resistance, I front-ran my setup and went long. Now its below my entry but should I now fall back to my original plan?

But that's not what I planned to write about. The one subtle pitfall is that when you knows quite a few technical indicators, it is easy for you to selectively tune in to some and shun others depending on your emotional bias. Take ZNGA as an example, my original set up was to add at 176% Fib extension, but because of an intraday high volume break of an intraday resistance, I front-ran my setup and went long. Now its below my entry but should I now fall back to my original plan? Another example is more common. Let's say you went long on TZA gap support, and it failed. Instead of taking loss, you saw the 20 MA not far below so you held on. It failed. And instead of taking loss, you saw the 50 MA and the 50% Fib just below as confluence of support so you held on. Sounds familiar?

You see, it doesn't mean it would go against you all the time, but it's just that it would get you into bigger trouble than otherwise.

STO is oversold, but RSI is not. What do you do? Price is bouncing, but no positive divergence. What do you do? Trend line break, but no volume. What do you do? Price break all supports but there is a strong MACD positive divergence. You see, you can easily jump the gun on any indicator while it is in fact premature. Yes, trading may be an art, but that lack of rigid rules is reserved for the masters. The rest of us have better learn the rope and stick to a set of system and rigid rules and live to trade another day in order to someday master the art of trading. If you can't blame failures on one system/setup consistently, then you probably have fallen victim of the aforementioned pitfall.

Monday, April 23, 2012

PNRA - Target Reached

The rectangle target on the daily chart, along with the 50 Fib retracement level should draw in buyers. The 60 minute MACD also shows positive divergence on today's high volume gap down.

UPDATE: Didn't realize it's earning day AMC the next day. Step aside.

UPDATE: Didn't realize it's earning day AMC the next day. Step aside.

ZNGA - Added To Long Position

I am not sure what ZNGA was bouncing off. But after a whole day of consolidation, the volume came in after 3 pm. I added on the break of intraday horizontal resistance at 8.77. It did not break the gap resistance, nor did it make it back to tthe 200 week EMA at 9.27, but the sheer volume hinted this may have legs.

PWRD - Reached 2nd Buy Target

Lower channel line, 176% Fib extension on 5 day chart, coupled with the 12.44 50 day EMA, I couldn't resist and added some shares there this morning. The market is in selling mode, so I am not aggressive but at the same time I try to put the big picture in PWRD in perspective. See the long set up on 4/12/12 here.

AAPL - Instraday

AAPL has broken all supports! Given the earning is tomorrow, a likely bounce point could be the circled area.

Sunday, April 22, 2012

My 5 Year Old Using A Pair of Chopsticks

After numerous times of fussing to use a pair of chopsticks and ending up frustrated, my 5 year old can finally use a pair proficiently -- my wife's turn to feel accomplished!

My turn was back when I got him off the training wheels on his 10" bike:

Saturday, April 21, 2012

Don't Overstay The Flagging Welcome

OK, the sell signal is still on. The market is holding up, but the leaders are falling one by one: GOOG, AAPL, IBM, CMG, etc. Even PCLN is showing a bit of weakness. The inverse ETF's are all flagging, examplified by the TZA daily chart, but all others are flashing cup with handle patterns as well. But the bears have better make a move soon or the flags are going to turn into a channel!!

GRPN is has reached my favorite 123.6% overshot level exactly. But this is a falling knife. And given all the recent failed long setup viz ZNGA, SPRD, etc. I should get the message from the market by now and step aside.

YELP is not as ugly as the other two, but still down 27% from the high in less than a month. I did well selling into the strength while Dr. Fly gave back the entire 50% move without selling a share. I did end up accumulating 200 shares since the down trend as I nibble a few here and there. It is sitting right around its 200 week EMA.

This week's story has to be AAPL, with dramatic whipsaw including a best 1 day rally ever. TraderFlorida called his shorts almost impeccably except the morning when he was trapped in his dentist's office. LOL. He's got lots of guts to short AAPL the day after the biggest rally. But on the other hand, when you have the size of fund he has and has been on a streak, it's a different story.

TZA

VXX

SPXU

Else where, the social media stocks are taking it to the chin: GRPN, YELP, and ZNGA specifically. They are obviously rotated out. Strangely, however, the social media ETF, SOCL, is holding up surprisingly well.

SOCL

ZNGA

ZNGA just looks plain horrific. Down 42% in 2 months. I took loss on one half already. Still holding the other half, which is currently down 20%. Ouch! This is the likely outcome when you flock with the herd and follow the hype. But with Facebook going IPO in June, it wasn't hard to bite the bait. Just 300 shares but still painful. Currently it's sitting exactly at the 200 week EMA at 9.27.

GRPN

YELP is not as ugly as the other two, but still down 27% from the high in less than a month. I did well selling into the strength while Dr. Fly gave back the entire 50% move without selling a share. I did end up accumulating 200 shares since the down trend as I nibble a few here and there. It is sitting right around its 200 week EMA.

This week's story has to be AAPL, with dramatic whipsaw including a best 1 day rally ever. TraderFlorida called his shorts almost impeccably except the morning when he was trapped in his dentist's office. LOL. He's got lots of guts to short AAPL the day after the biggest rally. But on the other hand, when you have the size of fund he has and has been on a streak, it's a different story.

Friday, April 20, 2012

Going Defensive - XLU

With the stock leaders such as AAPL and GOOG taking a beating lately, if you're unwilling to go short or even all cash I suppose some conservative securities could be a compromise. The utilities ETF broke out the trend line today on the daily, and I took an initial position.

Channel Overshoot And Failure

PNRA daily chart shows an example of of Al Brooks' "channel overshoot and failure" as per my notes here. The upper trend line (dashed line) of the projected down channel is constructed by replicating the lower trend line and placed tangent to the highest price point. As shown where circled, we see an overshoot of this channel, but then it retreats back into the channel. That's an indication of weakness. A sell order on the next morning would have done well.

SNDK - Daily Chart

SNDK earnings selloff. So devastating it even skipped the "target" (37.40) and 76.40 Fib (37.25) by a mile. May be it will boomerang back to it on dead cat bounce. But wow, this is a short seller's dream.

ZNGA - Social Media Ain't Sexy No More

You mean even social gaming ain't sexy no more?! That wasn't a long hype at all, was it? Facebook hasn't even gone IPO yet.

Taking a new look at the charts, if the THIRD rectangle has to be drawn, the target would be 7.71! Not too many other support levels aside from the IPO debut around 8.75, and the all time low of 7.97. Let me just throw in the 150% Fib extension at 8.83 just so we don't all go freak out. (PS. That makes 8.80 area a confluence of support).

UPDATE: Just saw a support on the weekly chart!! 9.28. That's where it's bouncing off today.

Taking a new look at the charts, if the THIRD rectangle has to be drawn, the target would be 7.71! Not too many other support levels aside from the IPO debut around 8.75, and the all time low of 7.97. Let me just throw in the 150% Fib extension at 8.83 just so we don't all go freak out. (PS. That makes 8.80 area a confluence of support).

UPDATE: Just saw a support on the weekly chart!! 9.28. That's where it's bouncing off today.

MCD - Bounced On A Pile of Cushions

I had no idea what happened yesterday. But based on the daily chart. The down target was reached, along with a horizontal gap support as well as the 12 month up-trend line. I took an initial position yesterday, in case the 200 day MA's (red and magenta) wanted a visit. The exhaustive volume was too inviting to not get in for some shares.

CPST - Levels and Target

CPST has been in my IRA as a story stock for a while, much line AONE, unfortunately. In recent months, somehow it caught The Fly's attention. And now RaginCajun as well. Had a monstrous volume channel breakout yesterday. Today it's slated to hopefully ride the momentum via last night's Fast Money airtime by CPST's CEO. So let's take a look at some target and levels of interests on the daily chart.

The rectangle target is 1.33. 50% Fib retracement is 1.23. And 61.8 Fib and previous horizontal resistance at 1.30. Based on the premarket, it seems the game is on for CPST.

Thursday, April 19, 2012

TZA Charts

Day-traded the TZA 5 minute chart successfully today. Caught a pop in the morning and exited before the strange reversal lower. Wanted to re-enter but was a bit confused with the price action and so only reloaded token position. Still it worked out on the long side.

On the 60 minute, TZA is in an orderly down channel, with the 20 EMA under the 50 EMA. STO is in the over bought territory. Not pressed with much urgency in this time frame. But look at the daily next.

On the daily chart, TZA looks a lot more bullish. Recent double bottom with tremendous positive divergence. And now we have a nice looking cup with handle with favorable volumes. Instead of playing VXX, TZA seems a better instrument, in my opinion. I would allocate more on TZA over the volatility plays (VXX, TVIX).

On the 60 minute, TZA is in an orderly down channel, with the 20 EMA under the 50 EMA. STO is in the over bought territory. Not pressed with much urgency in this time frame. But look at the daily next.

On the daily chart, TZA looks a lot more bullish. Recent double bottom with tremendous positive divergence. And now we have a nice looking cup with handle with favorable volumes. Instead of playing VXX, TZA seems a better instrument, in my opinion. I would allocate more on TZA over the volatility plays (VXX, TVIX).

ZNGA - Swept By the Tide

The tide being the broad market - when the market sells across the board, only few get spared. For stocks that have been in a down trend, they stand even less chance. Today ZNGA took it on the chin and went way below the text book support. I dumped half of my holding today, holding the other half. Fundamentally I still like the company, and I know it's not going straight down to 0. This is dangerous thinking. But let me put it in a different light: I did my part in selling half in fear of it going lower, instead of hoping that it will bounce back. That should neutralize the thought process.

AAPL - Target

It's hard to imagine, but the textbook target is 548! So far the MACD on the 60 minute is not impulsive on the current down leg. So the good news is either positive divergence would be setup on reaching the target, or it can bounce on oversold condition. So far STO is oversold but RSI has a ways to go.

Wednesday, April 18, 2012

ZNGA - Still On Track

All hope is not lost, but ZNGA is still not out of the woods. We got what the 60 minute chart has foretold, and reach the target (see earlier posts). Let's look at the 5 minute chart:

It was fun watching it almost made a text book 1-2-3 reversal, and almost got a Ross Hook upon breaking point B. The volume characteristics were favorable, too. Unfortunately, it didn't pan out. But then it's a bit silly to look at the 5 minute chart for reversal on this strong down trend. All hope is not lost. Bottom line: we need a bigger bounce first before any talk of reversal. The low may or may not have been in. One negative is that that sell volume in the past few day have been on the heavy side and there is no positive MACD divergence to speak of. The 60 minute MACD is close to crossing up. That's why if we get an impulsive bounce then upon retest of the low, we'd be set up for a positive divergence. We have to wait and see.

It was fun watching it almost made a text book 1-2-3 reversal, and almost got a Ross Hook upon breaking point B. The volume characteristics were favorable, too. Unfortunately, it didn't pan out. But then it's a bit silly to look at the 5 minute chart for reversal on this strong down trend. All hope is not lost. Bottom line: we need a bigger bounce first before any talk of reversal. The low may or may not have been in. One negative is that that sell volume in the past few day have been on the heavy side and there is no positive MACD divergence to speak of. The 60 minute MACD is close to crossing up. That's why if we get an impulsive bounce then upon retest of the low, we'd be set up for a positive divergence. We have to wait and see.

ZNGA - Needs Double Bottom

Per my post yesterday, today is "the" day for ZNGA to hopefully hit a bottom. An hour ago, it printed 9.95. That's close enough to our target of 9.90. The volume on the 5 minute chart looked encouraging. Exhaustive volume as the low was hit, followed by even bigger volume on reversal. Now ideally we need to retest the low in order for any bounce to hold. No guarantee, but so far it's according to plan.

Per my post yesterday, today is "the" day for ZNGA to hopefully hit a bottom. An hour ago, it printed 9.95. That's close enough to our target of 9.90. The volume on the 5 minute chart looked encouraging. Exhaustive volume as the low was hit, followed by even bigger volume on reversal. Now ideally we need to retest the low in order for any bounce to hold. No guarantee, but so far it's according to plan.BTW, I was able to nudge the target rectangle to the right today to line up with the end of the source rectangle. The pattern looks complete.

Tuesday, April 17, 2012

ZNGA - Bounce May Be Coming

Whatever happened to social media as of late?! YELP, ZNGA, etc. all felt unloved. ZNGA in particular plummeted 6% as the rest of the market rebounded in earnest. Even AAPL, the biggest loser yesterday, came back with a vengeance, scoring the best one day rally ever (I took this from a stream, didn't double check the fact). I took a close look at the ZNGA charts just now. It seems a bounce could be near. Take a look at coincidental targets in the daily and the 60 minute charts below.

The 60 minute chart shows an orderly down trend (not good) with the measured rectangle targets met in succession. Today it went slightly below, but continues to bug the lower trend line of the channel. Now take a look at the symmetry of the larger rectangle based on the 10 day range between 3/21/12 and 4/3/12. The target is 9.90 and the targeted time frame is within 1 day away. This target and time frame are fitting well with the daily chart as well, with Fib 76.4 target at 9.84 (see the circled area on the daily chart). That's just 6 cents off the 60 minute target. One has to be in awe with the mathematical precision orchestrated by the market.

Note: Tradestation does not allow me to move the 2nd rectangle beyond where I put it, but if you'd mentally nudge it to the right by the margin of the overlap, or just count 1 more day, you'd see how the target just magically lines up with the time symmetry.

The 60 minute chart shows an orderly down trend (not good) with the measured rectangle targets met in succession. Today it went slightly below, but continues to bug the lower trend line of the channel. Now take a look at the symmetry of the larger rectangle based on the 10 day range between 3/21/12 and 4/3/12. The target is 9.90 and the targeted time frame is within 1 day away. This target and time frame are fitting well with the daily chart as well, with Fib 76.4 target at 9.84 (see the circled area on the daily chart). That's just 6 cents off the 60 minute target. One has to be in awe with the mathematical precision orchestrated by the market.

Note: Tradestation does not allow me to move the 2nd rectangle beyond where I put it, but if you'd mentally nudge it to the right by the margin of the overlap, or just count 1 more day, you'd see how the target just magically lines up with the time symmetry.

What's Wrong With This Picture?

SPY is up a whopping 1.6% so far today with another 1.5 hours to go. Here's the 60 minute chart. Green candles all day.

Here's the money flow:

I am a bit confused.

UPDATE: It was just a wishful thinking. By the end of the day, the money flow rectified itself. Sorry if I had hyped any bear's hope up.

Here's the money flow:

I am a bit confused.

UPDATE: It was just a wishful thinking. By the end of the day, the money flow rectified itself. Sorry if I had hyped any bear's hope up.

Subscribe to:

Posts (Atom)